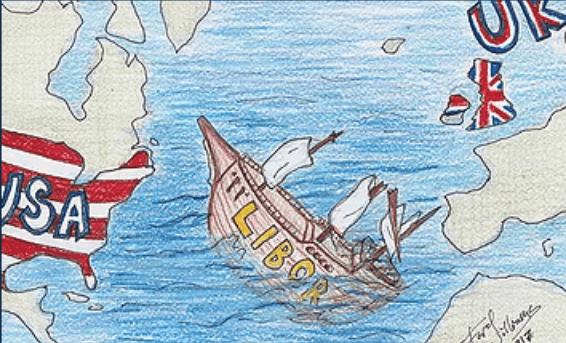

This is our top 10 list of what we expect to be happening at the end of 2021 when LIBOR disappears

- No institution will be fully and properly prepared for the transition away from LIBOR – firms will have been forced to make risk-based decisions to proceed anyway.

- Agitated Regulators and Supervisors. LIBOR transition will be a top-of-mind regulatory issue. “WHERE ARE YOU ON YOUR LIBOR TRANSITION PREPARATION!”

- Trading Market disruptions. Volatility in rates markets. A small number of well-prepared banks, recognizing that the transition process will increase both basis and currency risk, will have been taking advantage of the general marketplace since Q2, 2020.

- LIBOR makes front-page financial news every week.

- Winners and losers. Banks, Asset Managers, Corporations will transfer a legacy book from a LIBOR-link to a SOFR or SONIA or other reference rates. These legacy book transfers will be done initially for a single product in a single currency – derivatives, loans, mortgages; USD, GBP etc. This will be done under some duress as time will be running out, and under strong peer pressure, even though systems are not really ready, risk management not really ready, financial reporting not really ready. Six months later you will wish you had not moved that book, in that currency, in that product, and had moved a different book first instead. Just saying ’no’ not a business option.

- Excel. Cash product booking systems will not be developed, tested and deployed in time for transition due to the complexity of new product curves and protocols (SOFR) and lack of clarity and consistency from all FRB ARRC product working groups. Firms have to build shadow and addendum booking and calculation systems on Excel spreadsheets.

- Third-Party Vendor systems sit as ‘amber’ on every Transition Roadmap, as no one really knows what they are doing.

- Clients are very annoyed. They don’t trust banks. They don’t like change. They are suspicious. They complain to the press and to the regulator in Europe and the UK. They litigate in the USA.

- The safest job in America is not actually LIBOR Transition manager – maybe a close 2nd. It is the mail (or email) clerk sending out all the client documentation updates, changes and disclosures.

- Bank’s financial reporting becomes inconsistent and constantly re-stated. (Capital, NIM, Risk models and KRI all dependent on LIBOR).

- ABS, FRNs (difficulty in identifying end-user in face of 100% consent requirement) are the two product laggards. Derivatives, followed by Loans, followed by…

- LIBOR Transition switches from a distracting annoyance on the budget side to more like an enforcement action. The management message becomes “just do it, we have run out of time, spend whatever you must to resolve…”

COPYRIGHT 2021. ALL RIGHTS RESERVED.

SITE DESIGNED AND MAINTAINED BY PLAY NICE TOGETHER

Recent Comments